Remember that this information is provided on a quarterly basis. Tax Deduction and Collection Account Number (TAN) of the deductor and the amount of TDS deducted and deposited are also mentioned. Here’s a list of sub-parts of Form 26AS: Form 26AS Part A – Details of Tax Deducted at Source (TDS)įorm 26AS Part A consists of details of TDS deducted from your salary, interest earned, pension income and prize winnings etc. Details of the High-value Transactions in respect of shares, mutual fund etc.įorm 26AS is a very elaborate document with multiple parts.Details of refund received by you during the financial year.Advance tax, self-assessment tax, and regular assessment tax deposited by PAN holders/taxpayers.Tax deducted by the deductor (could be the employer, bank etc.) on behalf of the taxpayer and also, the details of tax deducted on your income.Details of all the tax collected by the tax collectors on behalf of the taxpayer.Details of Annual Information Report transactions.Form 26AS contains the following details: When we say that Form 26AS contains all tax related information of the taxpayer, we really mean all of it. One can access form 26AS from the income tax website by using their User ID which is also their PAN (Permanent Account Number). It includes all taxes that have been paid by or on the behalf of the taxpayer, by the deductor (could be the employer, bank etc.) to the Government treasury. 8 What are the important details in Form 26AS?įorm 26AS is also known as Annual Consolidated Tax Statement and provides a record of all the tax-related information of the taxpayer annually.

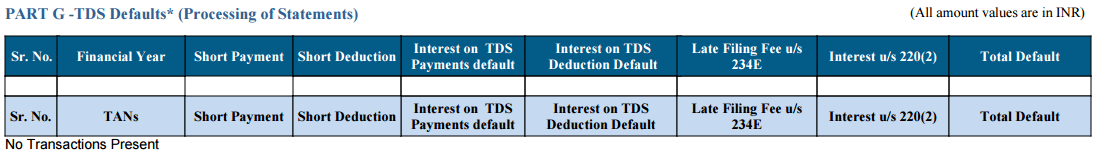

3.9 Form 26AS Part G: TDS Defaults*(Processing of Defaults).3.8 Form 26AS Part F: Details of Tax Deducted on Sale of Immovable Property u/s 194IA (For Buyer of Property).3.7 Form 26AS Part E – Details of AIR Transaction.3.6 Form 26AS Part D – Details of Paid Refund.3.5 Form 26AS Part C – Details of Tax Paid (Other than TDS or TCS).3.4 Form 26AS Part B – Details of Tax Collected at Source.3.3 Form 26AS Part A2: Details of TDS on the sale of any Immovable Property under Section 194(IA) (for the seller of the property).3.2 Form 26AS Part A1 – Details of TDS for Form 15G/ Form 15H.3.1 Form 26AS Part A – Details of Tax Deducted at Source (TDS).

0 kommentar(er)

0 kommentar(er)